-

Audit

Auditing increases the reliability of your company information for decision-makers and users – it’s a matter of credibility and trust.

-

Assurance

We have established Assurance Service Lines in the area of audit-related consulting so that we can support you in identifying the risks and challenges relevant to you.

-

Technology consulting

Receive customised technology consulting

-

Operational excellence and restructuring

Advisory for businesses, whatever situation they’re in

-

Deal Advisory

We’ll advise you on national and international transactions

-

Valuation & economic and dispute advisory

We’ll value your business fairly and realistically

-

Tax for businesses

Because your business – national or international – deserves better tax advice.

-

Private Clients

Wealth needs trust, transparency and clever minds. We can do that!

-

Business Process Solutions

Measuring and utilising company data

-

Real estate tax

Real estate taxation – we provide answers to your questions!

-

Tax for financial institutions

Financial services tax – for banks, asset managers and insurance companies

-

Tax in the public sector

Advisory and services for the public sector and non-profit organisations

-

Employment law

Representation for businesses

-

Commercial & distribution

Making purchasing and distribution legally water-tight.

-

Compliance & directors’ liability

Avoiding liability at your company

-

Inheritance and succession

Don’t leave the future to chance.

-

Financial Services | Legal

Your Growth, Our Commitment.

-

Business legal

Doing business successfully by optimally structuring companies

-

Real estate law

We cover everything on the real estate sector.

-

IT, IP and data protection

IT security and digital innovations

-

Litigation

Designing solutions – we’re your partner for successfully resolving disputes

-

Mergers & acquisitions (M&A)

Your one-stop service provider focusing on M&A transactions

-

Restructuring & insolvency

Securing the future in the crisis.

-

Technology consulting

IT enables business

-

IT assurance

Rapid technological change is a sign of our times.

-

Tax Technology

Digitalisation for tax and finance departments

-

IT, IP and data protection

IT security and digital innovations

-

Public sector

Digitalisation, processes & projects

-

Cyber Security

Advice and services for the mid-market in Germany

-

Security consulting

Stay on course, even in stormy times

-

Sustainability strategy

Laying the cornerstone for sustainability.

-

Sustainability management

Managing the change to sustainability.

-

Legal aspects of sustainability

Legal aspects of sustainability

-

Sustainability reporting

Communicating sustainability performance and ensuring compliance.

-

Sustainable finance

Integrating sustainability into investment decisions.

-

Grant Thornton B2B ESG-Study

Grant Thornton B2B ESG-Study

-

International business

Our country expertise

-

Entering the German market

Your reliable partners.

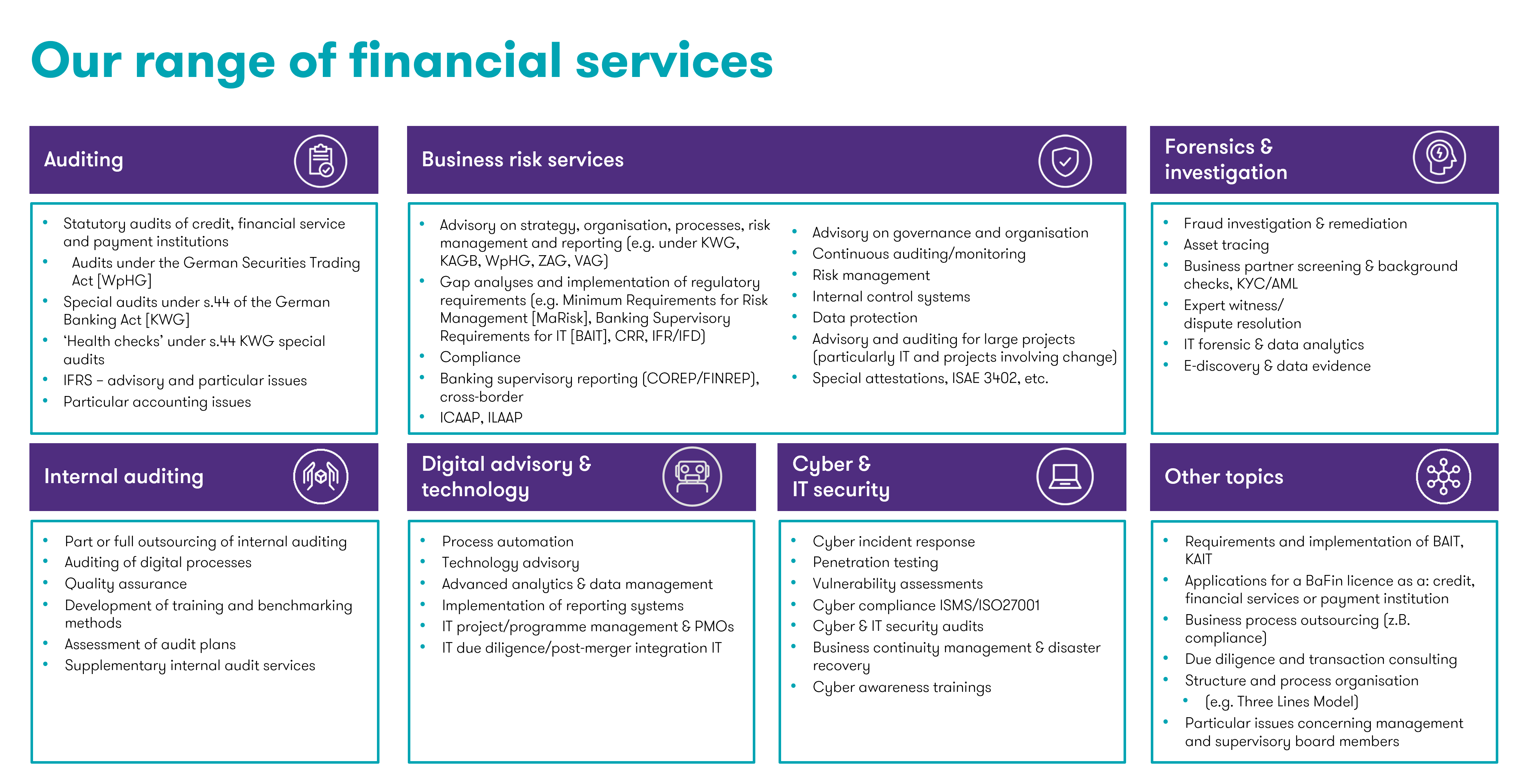

Regulatory changes, pressure on cost management, the need to grow, and increased investments in technology and data are dominating the financial services sector

The credit and financial services economy is currently facing additional major challenges due to the corona pandemic unlike anything seen in the history of post-war Germany. So many credit and financial service institutions are currently focusing on shoring up the resilience of their business. At the same time, climate change and the impact of Brexit cannot be ignored. Furthermore, the constantly changing regulatory requirements in the financial services sector continue to place enormous demands on market participants. In this new world, organisations that are operationally agile and possess strong infrastructure can use change and innovation to leverage potential and to exploit market opportunities.