Everything mid-market companies need to know about commercial due diligence (CDD)

Commercial due diligence examines the attractiveness of a target’s business model, the stability of its business environment and the viability of its business strategy. It plays a crucial role in designing and executing M&A transactions, which is why it is important to design the process properly.

Commercial due diligence supports buyers by assessing their investment hypotheses and making well-founded decisions by identifying the strengths and risks of the target.

Sell-side analysis helps sellers by providing extensive and transparent analysis of the business to offer potential buyers a clear picture and to maximise the purchase value.

We offer companies looking to raise finance and independent overview of their business model. This analysis helps banks and other investors make decisions on financing.

We’ll support you!

Our commercial deal services team have extensive method knowledge and excellent industry know-how. Before a transaction, our analyses provide you with insights into the strengths, weaknesses, opportunities and risks of the target, allowing you to make informed decisions, minimise risks and identify opportunities for strategic growth after acquisition. Find out how we give you clear insights and optimise your strategy for the following types of transaction.

This is what commercial due diligence from Grant Thornton has to offer.

For financial investors

Commercial due diligence offers financial investors the way to check their investment hypotheses, and potentially disprove them. With our extensive analysis we support you with your decide to invest and detect any potential risks. We identify possibilities to diversify and grow that can enhance your investment strategy. Our detailed assessment helps you to identify improvements in performance and potential for synergy, mitigate risks and secure a strong negotiating position to manage your investments as well as possible.

For strategic investors

Strategic investors profit from our CDD through objective and independent assessment that goes beyond your existing industry knowledge and takes the load off your internal capacities. We offer precise insight into regional markets, potential funding strategies and potential for synergies that support your strategic planning. Our analysis helps you to identify and mitigate potential risks early, recognise possibilities to diversify and grow in order to optimise your market strategy and strengthen your negotiating position.

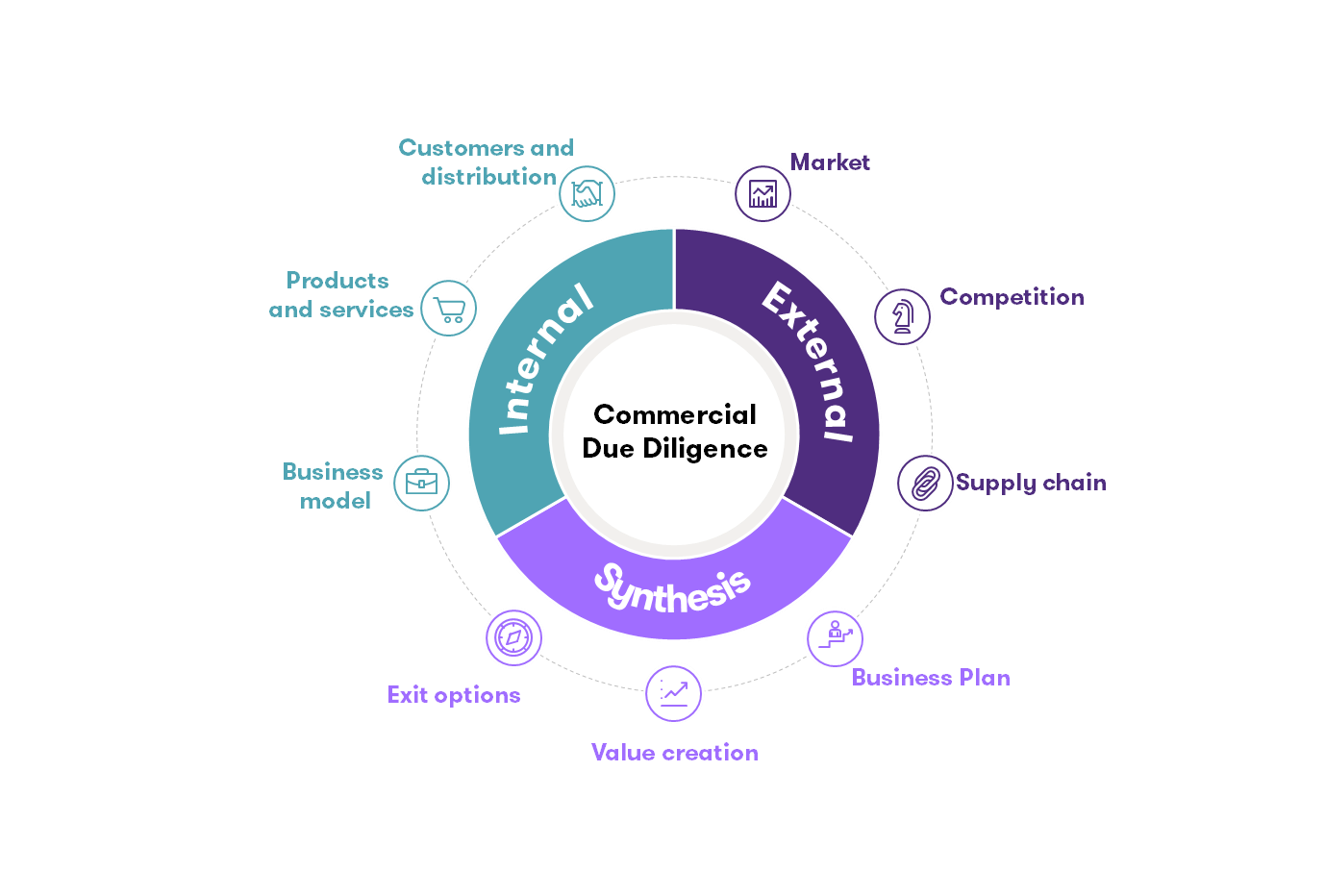

What does commercial due diligence examine?

Commercial due diligence is always related to the future and casts light on all aspects of a target that are relevant to its future success. For every challenge you face, we find the right solution.

Business model – We examine the entire structure and organisation of the business, including its vision and goals. Our SWOT analysis sheds light on strengths, weaknesses, opportunities and risks. We evaluate the business’s activities to create value and core competences as well as its economic development.

Products and services – Our analysis includes the business’s products and services, including drivers of sales and income and pricing. We also evaluate the sustainability and future viability of the products being offered.

Customers and sales – We examine the business’s customer base, including target customers, customer satisfaction and dependency on certain customers. We also evaluate customer behaviour, turnover, barriers to change and the relevant sales channels.

Market analysis – We analyse the relevant potential market related to the business’s size, development and position. We also identify important influences, market drivers, new market entrants and barriers to entry.

Competition – Our focus is on the situation regarding competition in the relevant market environment. We analyse the market concentration and the competition’s strategic positioning to develop potential for differentiation and unique selling points. This also includes identifying critical factors for long-term success in the market segment.

Supply chain – We examine the structure of supply chains, including procurement volumes, dependencies on suppliers, alternatives, resilience of the supply chain and the business’s logistics competence.

Business plan – We evaluate the company’s business plan, especially the sales and earnings budgeting for the coming years. We identify opportunities for growth and check the measures taken to realise these opportunities.

Ways to grow and diversify – Our analysis points out potential ways to grow and diversify that can support your investment strategy.

Exit options – We identify potential groups of buyers and evaluate their interest in your business from an outside perspective, based on our extensive network.

Our approach

We are absolutely convinced that commercial due diligence analyses are most informative when they are based on hard facts and expressed in figures. Our analyses therefore always include qualitative and quantitative elements and can be perfectly combined with financial, tax and other due diligence. In this way you get a comprehensive picture with coherent statements, figures and presentations.

For our analyses we also use publicly available and commercial databases and the most up-to-date data analytics software. Furthermore, we conduct interviews in the market and with experts to deliver an evaluation of the market that hits the mark. If desired, we also conduct disguised structured interviews with customers and suppliers.

By forming hypotheses our team can combine quantitative and qualitative approaches, especially in niche markets where the amount of data is very limited. We use specialised databases and analysis tools and supplement these with exploratory and structured interviews in the market and with experts.

Professional commercial due diligence minimises risk

Our experts examine your business (or the target) from a 360° perspective, in which they detect weak points and risks that can be evaluated, and future opportunities and potential which you can develop. We take into account the specific needs for information of equity providers and lenders (banks and others).

Our commercial due diligence offers you:

- A focused approach, that validates the central investment hypotheses and is tailored to users

- A clear identification of the value and sales drivers of the business model using extensive data analytics and access to numerous sector experts

- A reliable quantification of the relevant potential market that is typically tested multiple times, based on our own market models

- A profound understanding of the relevant trends in the entire ecosystem based on primary and secondary research

- A reliable estimate of the stability and capacity to develop customer relationships, based on telephone and/or online surveys

- A benchmark-based view of the direct and indirect competition, identifying critical factors for success

- A qualitative and quantitative estimate of the potential for growth, taking into account planned and unplanned growth initiatives

With a commercial due diligence check our experts create a detailed basis for the impending negotiations. We intend to accompany you through the entire process and think in investment cycles (from platform investments to add-ons, all the way to exit). We are looking forward to supporting you with your project. Contact us now.

FAQ – Frequently asked questions on commercial due diligence

In commercial due diligence, the target is analysed, including its position and potential in its environment of competition. Alongside opportunities, the focus is also on risks that arise from the business plan or the business’s strategic set-up. Internal factors are taken into account just as much as tendencies in the market and the competition. The analysis is designed to give an answer to the question how viable a business and its products or services are for the future. Due diligence is especially relevant in M&A deals, that is, when one business buys another.

In commercial due diligence, a business is carefully examined from the perspective of the customer, market and competition. This involves aspects of business planning and compatibility with the acquiring business ahead of an M&A deal.

The time commercial due diligence takes depends which factors of the business are to be evaluated, i.e. what the scope of the examination is. Several weeks should be planned for, and up to several months in the case of a more extensive check.

Besides the traditional buy-sell and sell-side (vendor) due diligence, there is the commercial fact book. This is similar to commercial vendor due diligence. However, it does not offer an independent estimate but the perspective of the seller or its advisor. It is typically less extensive and does not include any liability (reliance) on our part. Analyses in a commercial fact book may be coordinated to match the equity story in order to support it.

Combining commercial due diligence with other types of due diligence like financial, tax or legal due diligence from Grant Thornton offers significant benefits in efficiency. Collecting and processing data centrally eliminates the need for multiple requests and streamlines collaboration. By coordinating work across all the disciplines, the amount of coordination and the costs can be reduced considerably. A combined report makes for a consistent and easily understandable overall picture for investors, advisers and banks.