-

Audit

Auditing increases the reliability of your company information for decision-makers and users – it’s a matter of credibility and trust.

-

Assurance

We have established Assurance Service Lines in the area of audit-related consulting so that we can support you in identifying the risks and challenges relevant to you.

-

Technology consulting

Receive customised technology consulting

-

Operational excellence and restructuring

Advisory for businesses, whatever situation they’re in

-

Deal Advisory

We’ll advise you on national and international transactions

-

Valuation & economic and dispute advisory

We’ll value your business fairly and realistically

-

Tax for businesses

Because your business – national or international – deserves better tax advice.

-

Private Clients

Wealth needs trust, transparency and clever minds. We can do that!

-

Business Process Solutions

Measuring and utilising company data

-

Real estate tax

Real estate taxation – we provide answers to your questions!

-

Tax for financial institutions

Financial services tax – for banks, asset managers and insurance companies

-

Tax in the public sector

Advisory and services for the public sector and non-profit organisations

-

Employment law

Representation for businesses

-

Commercial & distribution

Making purchasing and distribution legally water-tight.

-

Compliance & directors’ liability

Avoiding liability at your company

-

Inheritance and succession

Don’t leave the future to chance.

-

Financial Services | Legal

Your Growth, Our Commitment.

-

Business legal

Doing business successfully by optimally structuring companies

-

Real estate law

We cover everything on the real estate sector.

-

IT, IP and data protection

IT security and digital innovations

-

Litigation

Designing solutions – we’re your partner for successfully resolving disputes

-

Mergers & acquisitions (M&A)

Your one-stop service provider focusing on M&A transactions

-

Restructuring & insolvency

Securing the future in the crisis.

-

Technology consulting

IT enables business

-

IT assurance

Rapid technological change is a sign of our times.

-

Tax Technology

Digitalisation for tax and finance departments

-

IT, IP and data protection

IT security and digital innovations

-

Public sector

Digitalisation, processes & projects

-

Cyber Security

Advice and services for the mid-market in Germany

-

Security consulting

Stay on course, even in stormy times

-

Sustainability strategy

Laying the cornerstone for sustainability.

-

Sustainability management

Managing the change to sustainability.

-

Legal aspects of sustainability

Legal aspects of sustainability

-

Sustainability reporting

Communicating sustainability performance and ensuring compliance.

-

Sustainable finance

Integrating sustainability into investment decisions.

-

Grant Thornton B2B ESG-Study

Grant Thornton B2B ESG-Study

-

International business

Our country expertise

-

Entering the German market

Your reliable partners.

Background:

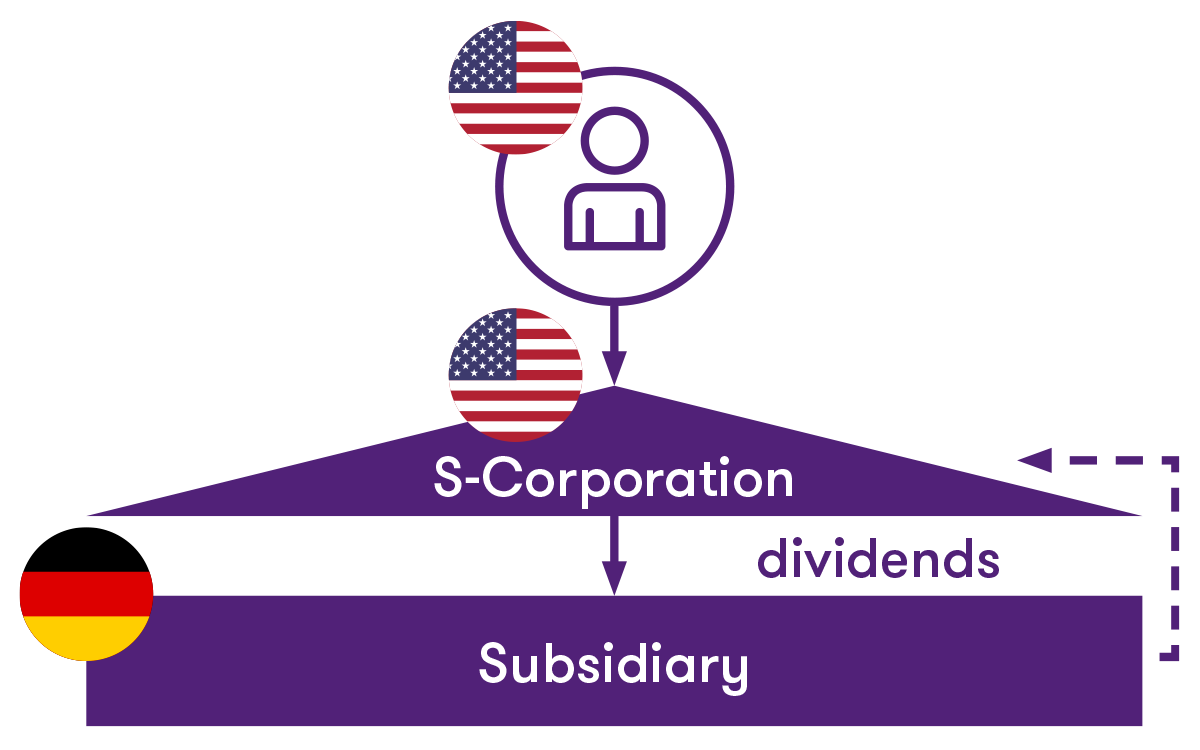

Mid-market US companies are frequently structured as S corporations, i.e. individuals resi-dent in the USA for tax purposes hold shares in a US corporation. The US corporation is in turn a shareholder in various foreign companies, for example a German GmbH.

The special characteristic of an S corporation structure is that the US corporation is taxed transparently in the USA, i.e. it is not the US corporation that has to pay tax on its income in the USA, but rather its shareholders (individuals). This mode of taxation is used if applied for under subchapter S of the US Internal Revenue Code, hence the name ‘S corporation’.

From a German tax point of view, however, S corporations are regarded in a comparison of legal forms as non-transparent, i.e. the income of the company is attributed to the S corpora-tion from a German tax perspective – and not to the shareholders. S corporations are there-fore hybrid companies.

Source: Grant Thornton Germany

Question:

The WHT rate to be applied to the dividends paid by a German subsidiary to a S corporation has been a point of contention for many years. The Double Tax Avoidance Agreement be-tween the USA and Germany provides for a residual tax rate of 15% for individuals as share-holders in German corporations. US corporations as shareholders, however, are generally entitled to a lower residual tax rate of 5% and under certain conditions even 0%.

As early as 2013, the German Federal Fiscal Court held (judgment dated 26 June 2013 – I R 48/12, Federal Tax Gazette (BStBl). II 2014, 367) that in such circumstances the lower resid-ual tax rate for corporations of 5% or 0% generally applied, since the ‘German’ classification of S corporations as corporations was definitive. However, this judgment was passed before section 50d(1) sentence 11 EStG had been introduced (now incorporated with the same wording into section 50d(11a) EStG), which concerning hybrid companies states that ‘only persons to whom the capital gains [...] are attributed as income or profits of residents under the tax laws of the other Contracting State are entitled to the [relief] claim [...]’.

Discussion ensued as to whether section 50d(1) sentence 11 EStG:

- has merely procedural character (i.e. it answers the question ‘who’ is entitled to claim relief); or whether it:

- also determines the applicable WHT rate (i.e. what is the applicable residual tax rate?).

In case (1), the residual tax rate would still be 0% or 5%; in case (2), however, German WHT at 15% would be charged on the dividends. The German fiscal authorities – naturally – take the latter view.

Decision

In its decision of 16 November 2022 (published on 10 March 2023), Cologne Fiscal Court held that section 50d(1) sentence 11 EStG (now section 50d(11a) EStG) has merely procedural character.

As a result, dividend distributions to S corporations are subject to the lower rate of 0% or 5%, with this entitlement to be claimed by the individuals.

Outlook & recommendation for action

The judgment is a significant contribution towards eliminating legal uncertainty and sets limits to the tax authorities’ pro-taxation stance. However, the tax authorities filed an appeal against Cologne Fiscal Court’s decision at the Federal Fiscal Court (file reference I R 13/23). Tax-payers will therefore still have to wait for a final and hopefully desirable decision by the Fed-eral Fiscal Court.

Until then it is important to keep relevant cases open and to claim the lower residual tax rate.