-

Risk Advisory

Security for your business

-

Digital advisory & IT consulting

Mastering digitalisation together

-

Operational Advisory

Solidifying and supporting transformation

-

Deal Advisory

We’ll advise you on national and international transactions

-

Valuation & economic and dispute advisory

We’ll value your business fairly and realistically

-

Financial Advisory

Optimising financial structures

-

Tax for businesses

Because your business – national or international – deserves better tax advice.

-

Tax for financial institutions

Financial services tax – for banks, asset managers and insurance companies

-

Employment law

Representation for businesses

-

Commercial & distribution

Making purchasing and distribution legally water-tight.

-

Inheritance and succession

Don’t leave the future to chance.

-

Financial Services | Legal

Your Growth, Our Commitment.

-

Business legal

Doing business successfully by optimally structuring companies

-

Real estate law

We cover everything on the real estate sector, the hotel industry, and the law governing construction and architects, condominium ownership, and letting and renting.

-

IT, IP and data protection

IT security and digital innovations

-

Mergers & acquisitions (M&A)

Your one-stop service provider focusing on M&A transactions

-

Sustainability strategy

Laying the cornerstone for sustainability.

-

Sustainability management

Managing the change to sustainability.

-

Sustainability reporting

Communicating sustainability performance and ensuring compliance.

-

Sustainable finance

Integrating sustainability into investment decisions.

-

International business

Our country expertise

-

Entering the German market

Your reliable partners.

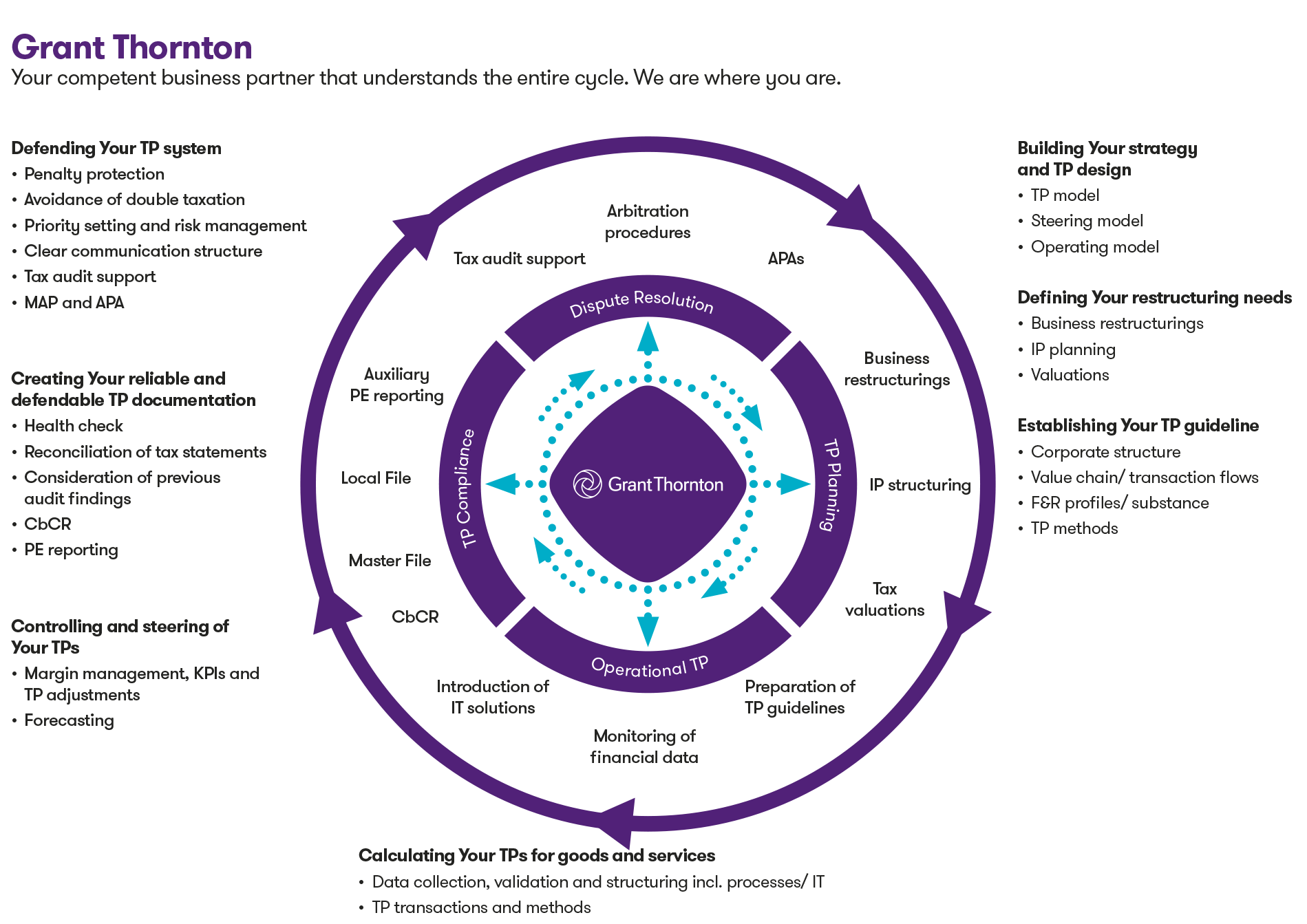

In cross-border supply and service relationships and financial transactions, governments want to tax the largest amount of profit possible. This conflict of interests is something we can solve for you. Our multidisciplinary team puts together comprehensive solutions that work at home and abroad. We work in coordination with our colleagues in the global Grant Thornton network. This way, we efficiently fulfil all the legal conditions and your objectives. Your business is our focus. Be convinced by our pragmatic and risk-orientated advisory.

We understand the entire economic cycle of your business and are always there just when you need us.

Our services

We understand our clients and our job. We find the right solution for every challenge you face.

The value chains of multinational enterprises and the value-adding contributions of the individual group entities change constantly. So it’s necessary to examine where within the business the contributions to value added are made. This is determined by the group entities’ function and risk profiles and the assets employed. Existing transfer pricing systems should therefore be checked regularly, particularly when breaking into new markets, with restructuring or acquisitions.

The right transfer pricing system also has to be practised. The key point is that the necessary processes are introduced or adapted. This includes the processes within the business just as much as implementation in the ERP system. There’s a lot of information to obtain and process, especially in interplay with managerial accounting. Serious risks in audits can come about due to faulty or incompletely implemented transfer pricing systems.

Meeting documentation obligations in an integral part of compliance requirements. It’s essential to avoid penalties or having to make adjustments. Taxpayers are confronted with ever more extensive documentation obligations. In an environment of more transparency, such as due to country-by-country reporting but also to tax authorities cooperating internationally, a purely national approach to documentation is not practical. With the help of our excellent international network, we can offer to compile for you high-quality domestic and foreign transfer pricing documentation as a complete package.

A combination of proper transfer price documentation, skill in negotiating and experience form the basis for a successful defence of transfer prices at an audit. The tax authorities have massively expanded their skills. If the increase in transparency is also taken into account, taxpayers are now often faced with having to make adjustments to their transfer pricing if they don’t prepare properly. Involving an experienced team of advisers helps to recognise pitfalls and risks in time and to design suitable strategies to minimise risk.

If adjusting taxes leads to double taxation, this can be avoided by applying for a mutual agreement procedure. In the case of particularly complex value-added chains or particularly important business relationships, an advance pricing agreement can help to achieve legal certainty at an early stage. Our many years of experience with both mutual agreement procedures and advance pricing agreements, our excellent relationship with the Federal Central Tax Office [Bundeszentralamt für Steuern] and our qualified colleagues in in other countries form the basis for carrying out the procedure successfully and efficiently.

Besides the question of setting them up, with permanent establishments the crucial point is dividing the profits between the head office and the permanent establishment. The authorised OECD approach (AOA), as it’s known, plays a key role here. According to the way it’s implemented in Germany, auxiliary and separate accounts must be compiled for permanent establishments as the basis for tax returns. We’ll support you with recording and documenting your HR functions and with the resulting questions on defining them.

Our awards

We’re proud of the awards we’ve won. And we’re just as happy that our clients give us top ratings! We’re working hard to keep it that way. And that’s a promise!

|

|

|

|