For every transaction to be successful, financial due diligence (FDD) is essential – whether for investors, sellers or lenders. Grant Thornton will support you with comprehensively analysing the target, assessing opportunities and risks, and determining the purchase price and what needs to be done right away.

Thorough financial due diligence is crucial for you to invest in company shareholdings. Our experts combine profound knowledge of the sector with international experience to give you a 360-degree view of the target – from analysing historic and budgeted financial data to assessing long-term potential. Trust Grant Thornton to minimise risks and to make decisions on a solid basis.

Our approach to financial due diligence

“A 360-degree view of financial and strategic details is indispensable today. Our financial due diligence lays a clear basis for our clients to make decisions and not only casts light on current figures, but also on future potential and risks. That’s how we help them act with assurance and foresight.”

Harald Weiß, Grant Thornton Partner

Not only do we analyse figures, but also strategic and operational aspects of the target to obtain a well-founded overall assessment.

Our experts uncover potential risks and point out opportunities that are important for your strategic decisions.

Your needs and urgent questions are paramount – to deal with these, we take a pragmatic and even unconventional approach when necessary.

What Grant Thornton can do for you

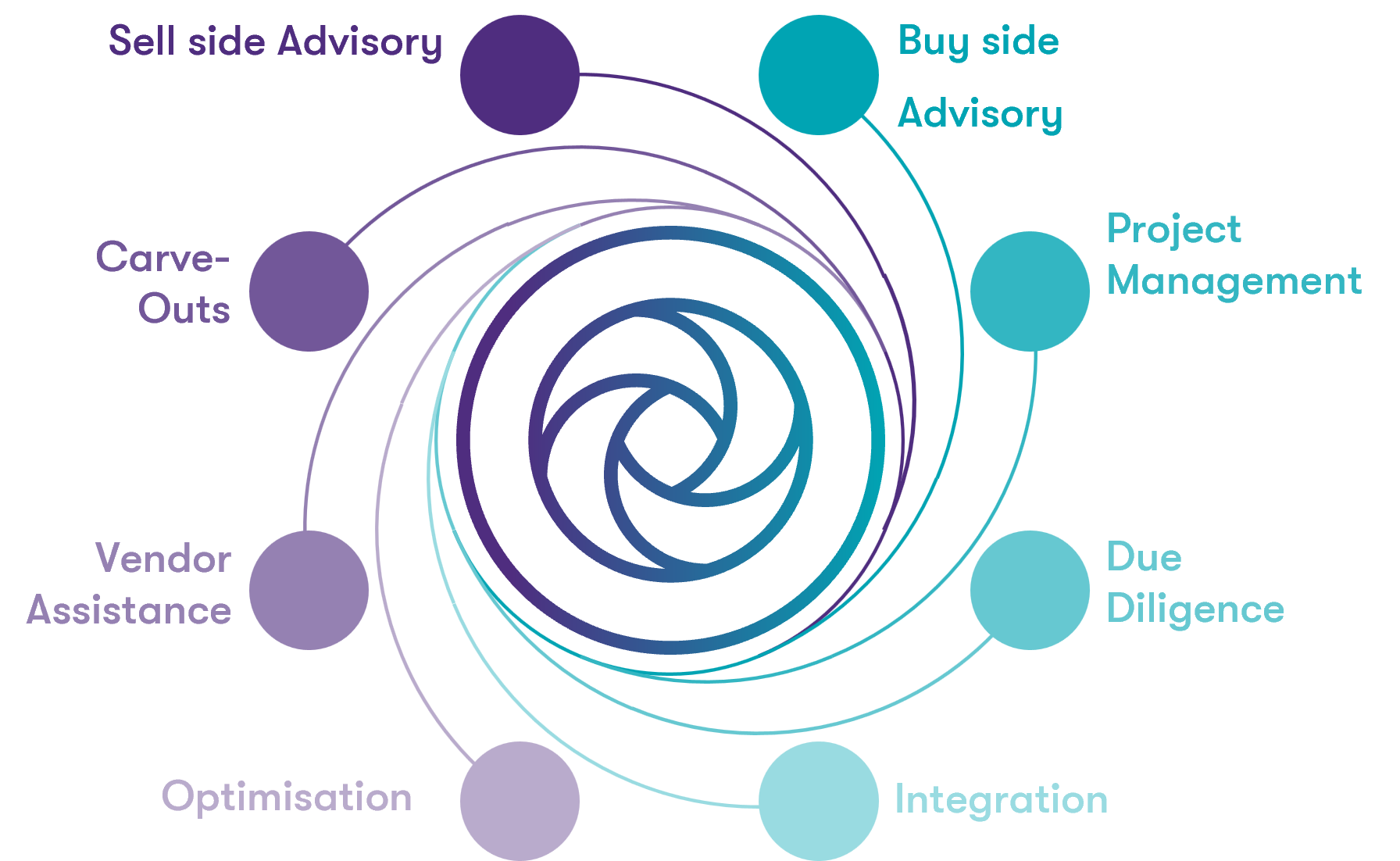

With our extensive portfolio of services we can assist you either with buying or selling a business, parts of a business or individual assets.

Trust Grant Thornton and our experts with your financial due diligence

Thanks to our profound knowledge of industries and decades of experience, we can give national and international companies effective advice.

As part of the global Grant Thornton network with over 73,000 experts in around 150 countries, we offer you access to in-depth market knowledge and regional insight.

Our offices in Germany mean we are always close and can guarantee personal and flexible advisory that focuses on your requirements and expectations.

Our awards

Frequently asked questions about financial due diligence (FDD)

Financial due diligence aims to analyse the financial situation of a business in a detailed way. It helps investors identify potential risks and opportunities and create an in-depth basis for deciding on investments, mergers and acquisitions.

Financial due diligence is particularly relevant to investors planning an acquisition (e.g. private equity investors, venture capitalists and corporate investors), banks and insurers as well as entrepreneurs selling their businesses (strategic interest, technological interest or business succession) or who are looking to start a joint venture.

Financial due diligence starts with planning and collecting data, followed by an analysis of financial and qualitative factors of the target. We identify potential risks and opportunities, draw up a detailed report with recommendations, and assist you with determining the purchase price and negotiations.

FDD includes an analysis of the statement of profit and loss, balance sheet and cash flow. It also includes tax, legal and market-related aspects to get a complete picture of the business’s financial stability and future viability.

While financial due diligence focuses on financial indicators, risks and the quality of the accounting, other kinds of due diligence, such as commercial, legal or technical, check various other dimensions of the business, e.g. market development, legal aspects or technical circumstances.

Our approach includes a 360-degree analysis that takes into account both quantitative and qualitative aspects. We use leading sources of data and combine financial analyses with information on the market and competition to offer you an all-round picture of the target.

After FDD has been completed, you will receive a detailed report containing the results, identified risks and opportunities and recommendations for action. Based on these insights, we will also support you with agreeing the purchase price and negotiations.

We also offer extensive support with further steps in the transaction process and beyond, including:

- Purchase price allocation – We’ll help you in correctly allocating the purchase price to the acquired assets and liabilities, both to fulfil regulatory requirements and maximise tax advantages.

- Post-merger integration – We’ll support you with seamlessly integrating the acquired business to exploit synergies effectively and increase the long-term value of the business.

- Annual financial statements check – With a thorough examination, we ensure that your financial reporting complies with legal requirements and creates trust for stakeholders.

- Tax advice: Our experts are available to answer all your tax questions, from optimisation to compliance with legal regulations.

- Payroll accounting: We’ll take care of payroll and ensure that all the legal regulations are kept so you can concentrate on your business.

We’ll also assist you with these services beyond due diligence and make sure your transaction is a success for the long-term.